How to buy lots of Bitcoin in just 1 day

Why you might want to consider using a Bitcoin ETF for larger lump sum purchases

Do you remember when you made your first, probably tiny, bitcoin purchase?

You might recall how daunting that experience can feel as a first timer. Not only are you risking hard earned money on a notoriously volatile asset you barely understand, but you’re also using websites or apps that are unfamiliar, may look sketchy and draw unwelcome attention from your bank’s fraud department - which you’ve probably never had to deal with before.

As you start to really understand bitcoin better, you quickly realise you don’t have enough exposure to bitcoin and it becomes urgent to buy more - perhaps a LOT more - and you’ll want to do it fast before the price rips upward again.

Why is buying a lot different to buying a little?

As the amount you want to convert over increases, you’ll quickly encounter friction when attempting to move larger amounts (eg $10,000 or more at a time) from your traditional fiat bank accounts to a bitcoin exchange and then into cold storage.

Hurdles such as daily or monthly transfer limits, bank policies that automatically block your account whenever you attempt to transfer money to a “crypto” exchange and exchanges who also demand extensive KYC information in order to comply with arguably “guilty until proven innocent” Anti Money Laundering (AML) rules.

Most bitcoin exchanges only allow relatively small daily limits when you first open your account - lifting those limits can take a while…

Moving your bitcoin off the exchange and onto a cold wallet address can also come with additional hurdles - such as needing to record a scripted video while holding your driver’s license up to a camera and waiting for a few days while it gets approved.

Did I mention bitcoin is a volatile asset? While your next large purchase is being delayed by banks, your exchange, on hold music from call centres that “care for your safety”… the bitcoin price will inevitably do what it always does at the most inconvenient of times - run away from you - inducing further panic and FOMO (Fear of Missing Out).

Let’s imagine you’ve come into a windfall of some kind - an investment property sells, a wealthy aunt bequeathes you an inheritance, your lotto numbers came up or your super fund rollover has finally arrived.

You now have $1,000,000 in your account and you want to buy and self custody bitcoin before inflation eats your nest egg’s purchasing power away.

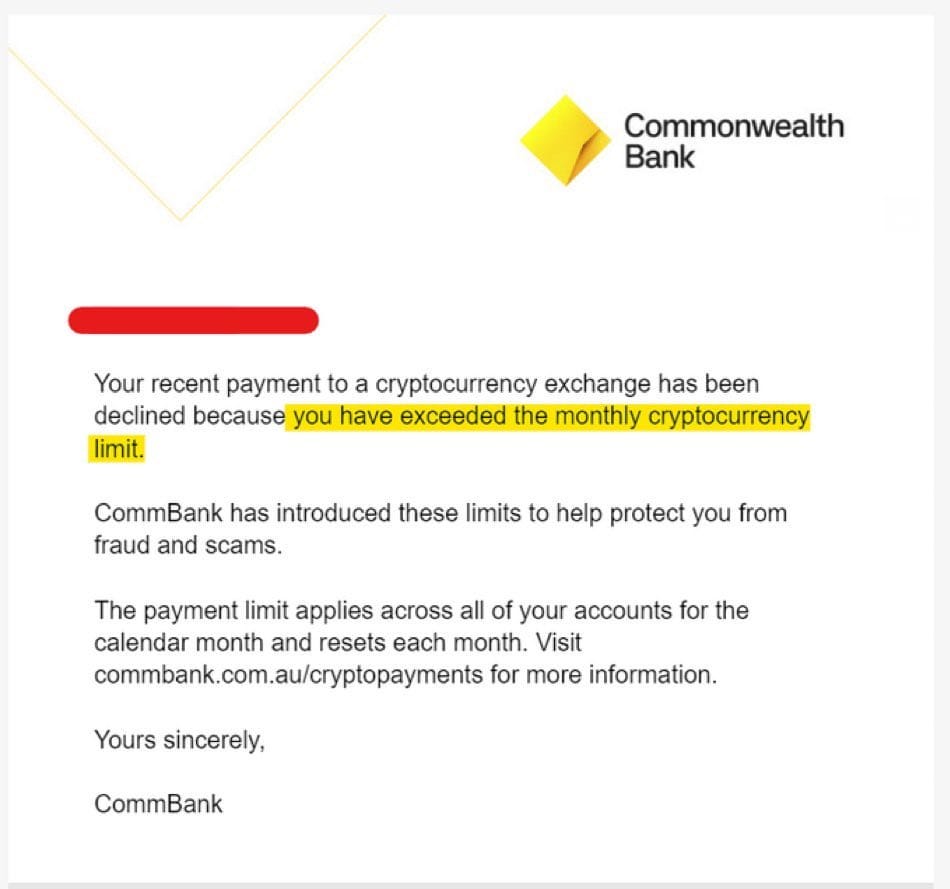

Australia’s largest bank, CommBank, for example, would block you from buying more than $10,000 worth per month, so if you bank with them, it would take you 100 months (over 8 years) to move that $1 Million over to Bitcoin. Meanwhile…

It would be great if there was a way of buying large amounts of bitcoin without such punitive and arguably arbitrary transaction limits or daily and monthly restrictions.

Outside of moving money into Bitcoin, Banks seem quite happy to allow you to do large daily transactions for investments they do approve of and encourage, like shares in public companies or ETFs (Exchange Traded Funds).

Bitcoin ETFs - Buying a large amount quickly

The recent advent of Bitcoin ETFs has now made it possible to get bitcoin price exposure using your existing share trading platform - go ahead, check - if you’ve ever bought or sold shares before, you probably already have an app on your phone that can do it:

Bitcoin ETF products provide exposure to Bitcoin in a regulated security that Banks are more comfortable and familiar with. There is generally no limit to the value of shares or ETFs you’re allowed to purchase on any given day.

ETF units are also a convenient wrapper around the complexities of holding and managing your own bitcoin private keys - something that people new to bitcoin or not as technology savvy can otherwise find difficult to tackle at first.

In exchange for an annual fee (from 0.15% - 0.25%), ETF units are like shares that track the underlying price of bitcoin.

ETF units can be bought and sold near instantly when the market is open, just like a share and, for new bitcoiners, you don’t need any knowledge of how bitcoin works.

Monochrome v other ETFs

Recently, an ETF product has come to the market in Australia - the Monochrome BTC ETF - that offers an off ramp back and forth from cold storage self custody bitcoin without incurring a CGT (Capital Gains Tax) event.

This is known as “in-kind” creation or redemption.

Unlike many other Bitcoin ETFs, the Monochrome ETF has been structured as a “Bare Trust” - meaning that the ETF units you purchase on the exchange represent direct beneficial legal ownership of the underlying asset in your brokerage account’s name.

This means that when you buy the ETF units from your brokerage account and later ask for them to be redeemed and transferred into your cold storage wallet, there is no change of beneficial ownership and therefore no CGT event occurs.

With other cash settled Bitcoin ETF products, each time you want to move Bitcoin from the ETF units to Bitcoin held in Cold Storage, you have to sell the ETF for its cash equivalent value in your local currency, then re-purchase the bitcoin on an exchange using those funds and then transfer the bitcoin back to cold storage - loosing to both transaction fees and having to pay any applicable capital gains taxes at the time.

Even if you don’t think holding your own bitcoin in a cold self storage wallet is important to you now compared to quickly getting the upside of bitcoin price growth, as you learn more about bitcoin, you’ll be very happy you have this option.

ETF v Exchange

What trade offs do you have when buying bitcoin in bulk on an exchange versus the Monochrome ETF?

As you’ll see, the advantages of using the ETF for buying large amounts are:

Fast and Easy to Buy (even a very large amount can be done same day)

Lock in today’s Bitcoin Exchange Rate (useful when price is running up fast)

On the downside:

Withdrawal process to self custody takes a while

Has some costs (currently $500 per in kind redemption request)

Redemption involves a lot of steps, especially the first time

When buying bitcoin on an exchange, its generally faster, easier and cheaper than the ETF to withdraw to self custody, but daily limits from either your bank or the exchange (or both) mean that buying large amounts will spread your transaction over multiple days at least or even much longer depending on the limit versus total amount you want to move.

When a significant upswing in Bitcoin price is underway, every delay in buying and locking in that price can be very frustrating.

From your Brokerage to your Cold Storage Wallet

This article will now walk you through in detail the steps of how to buy the ETF units and then everything you need to do to enable in-kind withdrawals to your cold wallet.

In summary, here’s the main steps we will cover:

Buying IBTC units on your brokerage app

Register your IBTC holdings with the Automic Unit Registry

Create a BTC account on the Gemini cryptocurrency exchange

Complete the Monochrome In Specie Redemption Form

Move your BTC from Gemini to your Cold Storage Wallet

Getting price exposure to BTC via the ETF is nearly immediate.

You should expect that the process to move the underlying Bitcoin to Cold Storage, depending on the complexity of the entity holding the units, can take around a couple of weeks of elapsed time or more.

Step 1: Buying IBTC Units

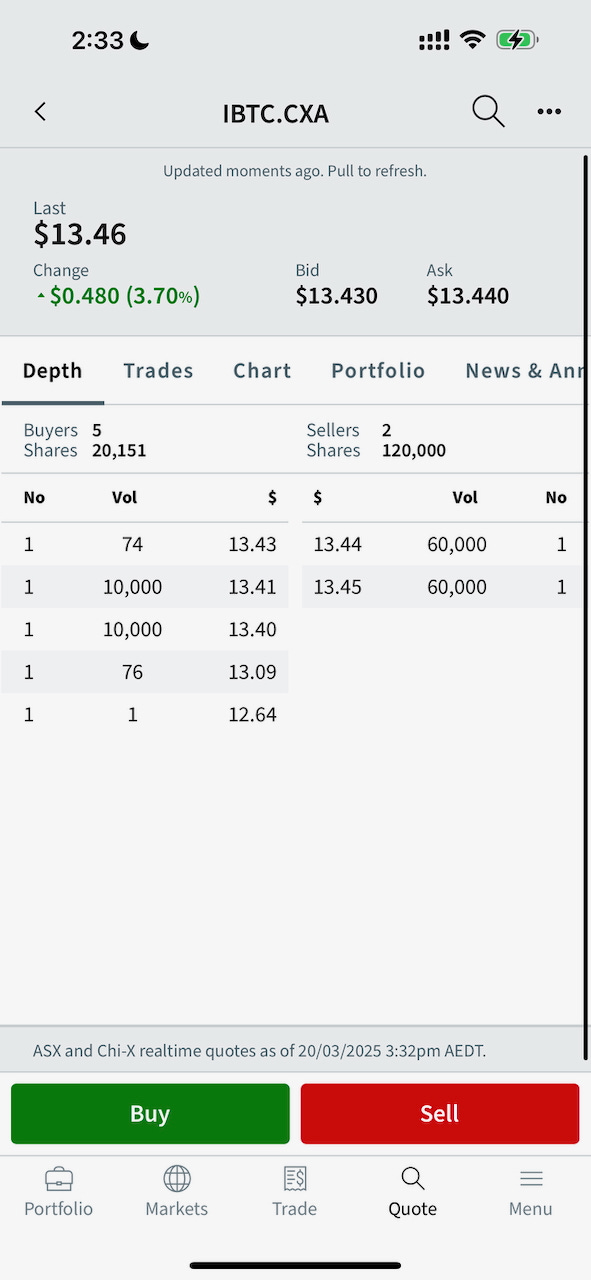

If you already have a brokerage app that allows you to purchase exchange traded funds (ETFs) chances are you can just go to that app, search for “IBTC” and select the “Monochrome BTC ETF”.

You will usually then be presented with the market depth screen - which shows you how many individual parcels of ETF units are for sale at each price point:

Don’t worry if there doesn’t appear to be enough units for sale to immediately meet your requirements - as you place a large order, additional units will be made available to meet demand.

You can also advise Monochrome and they will be able to work with the market makers to provide extra liquidity if required.

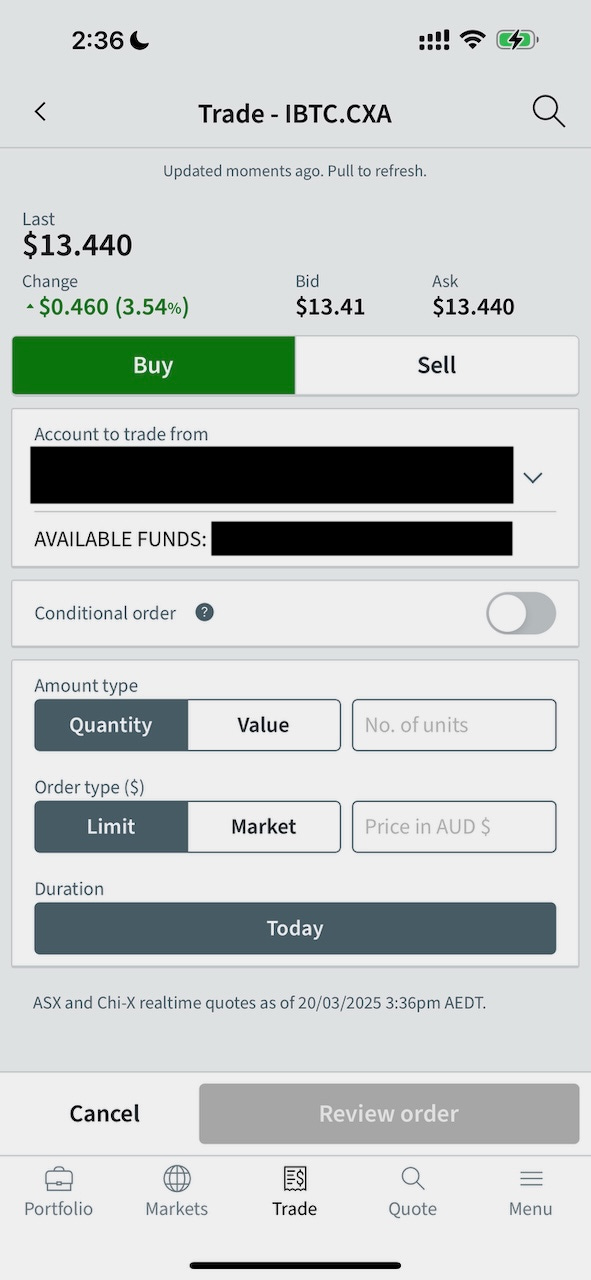

Then select how much you want to purchase either in dollars or in total number of ETF units and choose whether you want to offer to buy at a specific purchase price (known as a limit order) or you’re happy to accept whatever the current market price is.

When setting your limit order price, you are setting the maximum price you are prepared to pay per unit. Recognise that your order may be filled at a lower price or if the units start to trade above your limit price, that your order may not be filled.

You’ll then be prompted to confirm your order with a PIN code, FaceID or whatever security settings you’ve configured.

The CBOE Australia ETF market (where Monochrome’s IBTC product is listed) is open from 10:00 AM to 4:13 PM Sydney time, from Monday to Friday excluding public holidays. If you’ve placed your order during these times, you’ll see your order get fulfilled usually within a few minutes and the holdings will now appear in your NAB Trade app.

Otherwise, if you placed the order after market hours, keep an eye on your app after the market opens and be prepared to adjust your order price and quantity if the market price has shifted significantly in between.

Step 2: Register your IBTC holdings with Automic

If you’ve been trading securities for while, you may already know about share clearance and settlement registries like CHESS and Automic.

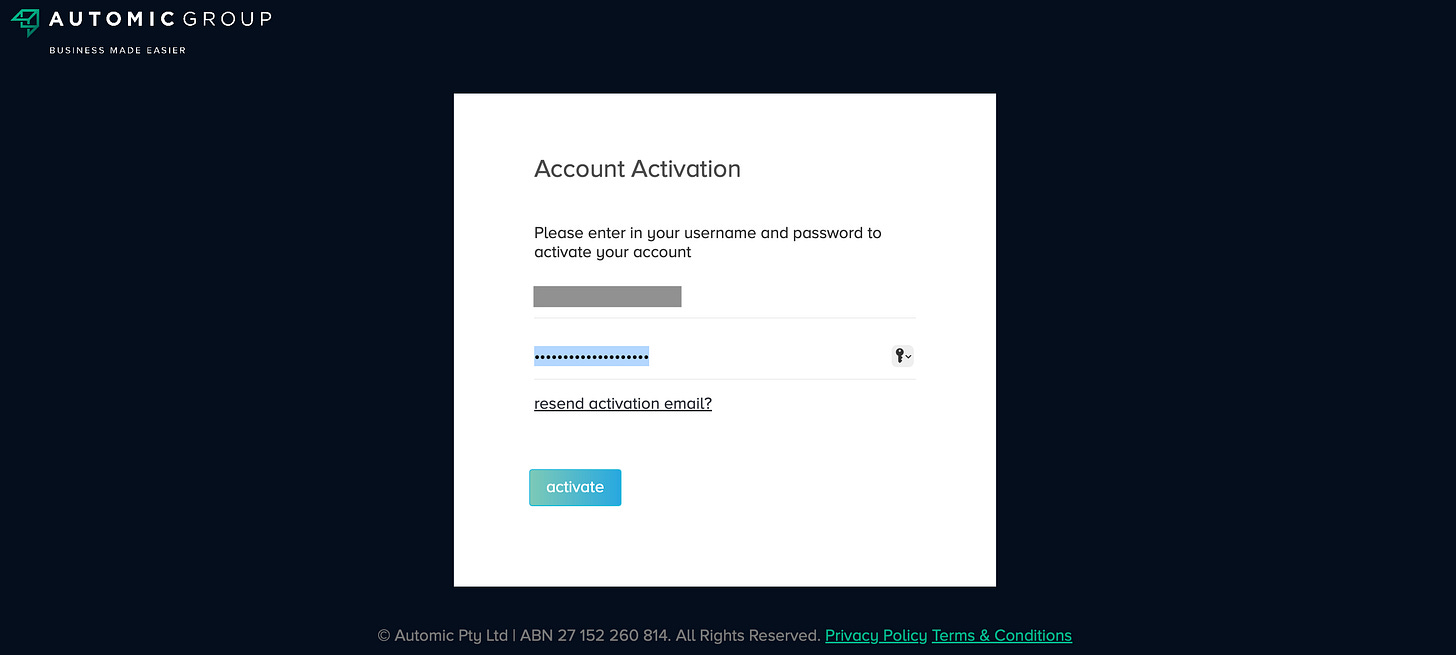

The Monochrome BTC ETF requires you to register your IBTC holdings with Automic (available at https://automic.com.au) as part of their in-species redemption process:

If you’ve never signed up for Automic before, you’ll need to hit the register button. Remember that you will need to register on Automic as the same entity name as the entity you used to purchase the IBTC ETF units on your share brokerage platform.

Enter your preferred email address, user name and password:

You’ll be sent an activation link via the email address you used to register - click on it and your account will now be activated.

Multi-factor authentication is mandatory for Automic - so you’ll need to make use of an app like Google Authenticator to set this up.

Follow the on screen instructions and when complete you’ll see this:

Once you’re registered and logged in, the next step is to register your new IBTC units with Automic. Press the Add Holding button on the main dashboard and you’ll be presented with the following pop up form:

You’ll now need to locate your HIN Number (Holder Identification Number) on the NABTrade portal (or whichever share brokerage platform you are using).

Enter that number on the pop up form and submit your request.

Your Automic dashboard will now display your ETF holdings, showing both the number of ETF units and current dollar value.

Before allowing you to redeem your bitcoin from the ETF units, Automic will require you to complete the US Government’s FATCA Tax Residence Self Certification form:

It’s worth getting your accountant or legal professional’s advice on how to correctly complete this form, especially if you are a US Citizen or you or any of your co-owners of your investment vehicle are US tax payers.

With Automic setup, FATCA form completed and your IBTC units connected, you’re ready to go to the next Step.

Step 3: Setup your account on Gemini

Gemini (one of the world’s oldest and largest crypto exchanges) is a custodian of the Monochrome BTC ETF coins. The redemption process requires your investment entity to register for an account on Gemini.

After redemption of your Bitcoin from the ETF units, your Bitcoin will be credited to a wallet accessible from your Gemini Account. You’ll then be able to withdraw the BTC using the Gemini crypto currency send function.

But first, you’ll need to register, if you haven’t already, an account on Gemini in the same entity name as you used when purchasing your IBTC units from your brokerage account.

Here’s a glimpse at what the new user registration process for Gemini looks like at the time of writing:

The registration process will feel familiar to any prior crypto currency exchange onboarding process you’ve previously been through.

However, one thing to note is that Gemini, as a US company, will require you to complete US Tax forms to verify your obligations towards US Tax liability - if any.

If registering as a business, Monochrome strongly encourages you to reach out to them by email or phone and notify them of your intention to redeem IBTC units.

There is an escalation process between Monochrome and Gemini that will mean your Business account application is treated with a higher priority (otherwise Gemini business applications from Australia can take days or weeks to receive an initial response).

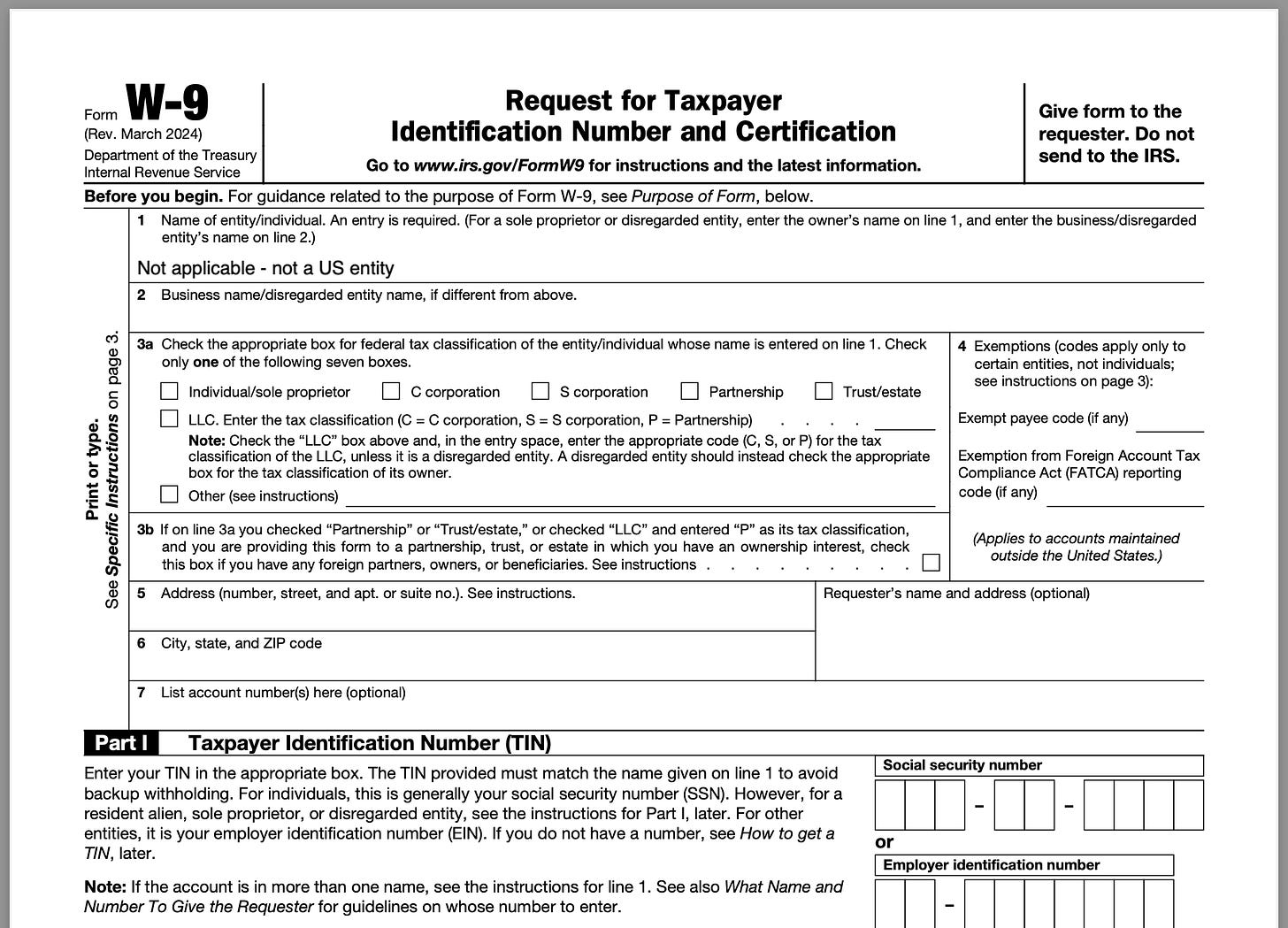

The online registration within Gemini will require you to submit a W-9 - this is what that form looks like:

If you are applying on behalf of a business entity, instead of as an individual, the application process will continue offline via email and a secure portal for exchanging documents.

Examples of a business versus personal application would be if you are redeeming units you’ve purchased on behalf of a superannuation fund, a trust structure or a company.

In this case, after submitting your application, Gemini will follow up by email and request you provide additional business documentation on their secure document exchange portal including:

Redacted statements of your business/entity bank account

Copies of Company Incorporation Documents/Trust Deeds etc as applicable

A Portfolio Holdings Report from your Brokerage Account

A recent ASIC Company Extract

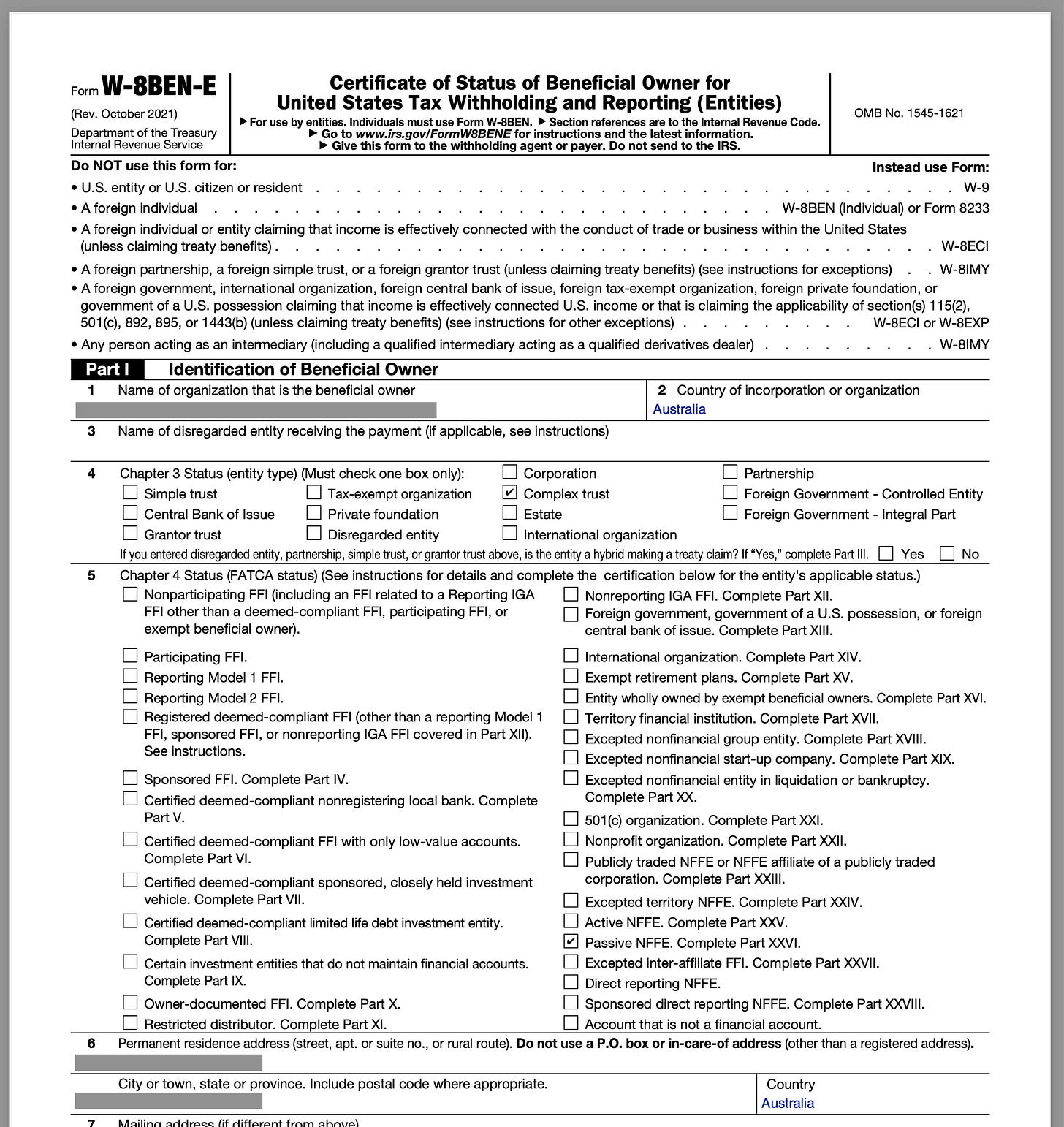

You’ll also be required to complete a W-8BEN-E IRS form - this is the form applicable for Australian incorporated companies to complete. The only complicated part of the form is Part 1 Question 5 where you will need to determine which is the correct US tax law classification for your entity and then complete further questions in the relevant section:

Once the documents have all be internally approved, you’ll receive an email welcoming you to the Gemini exchange platform and you’ll be able to sign in.

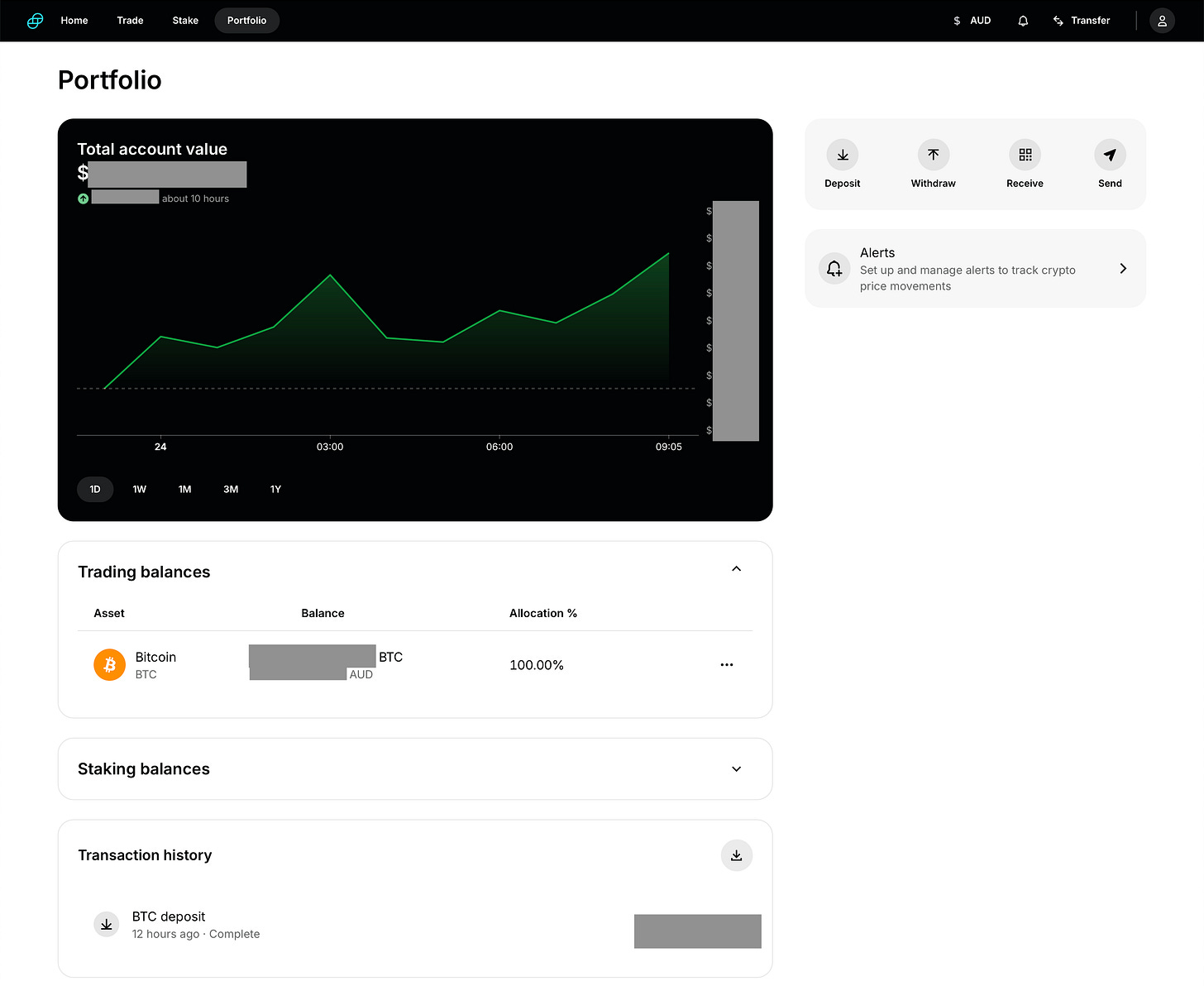

Upon signing in for the first time, you will have no BTC or AUD assets as yet:

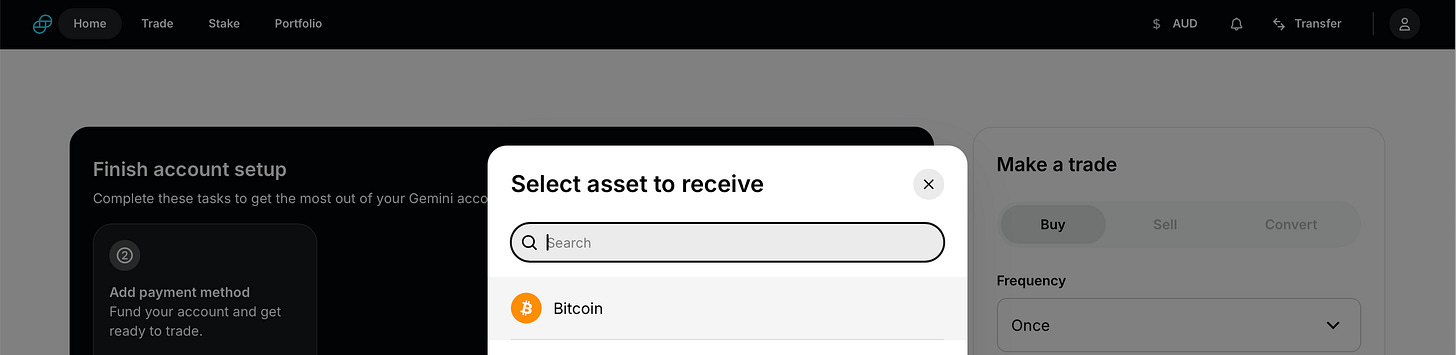

We now need to generate a wallet ID / Receive Address for our bitcoin to be transferred to our Gemini Bitcoin Wallet.

To do this, click on the Transfer link in the top main menu, then “Receive Crypto”:

Next select “Bitcoin” as the asset type:

This will then generate an address such as “bc1….” like the one shown:

Copy this address and paste it in a document/note taking application as you’ll need this later.

You’re now ready to request the redemption of the bitcoin from your IBTC ETF units over to your newly created Gemini BTC Wallet Account.

Step 4: Submit the In-Specie Redemption Form

Contact Monochrome if you haven’t already done so - their contact details are on their web site (https://monochrome.au). Ask for the In Specie Redemption Form. Note that at the time of writing, the In Specie redemption process requires a $500 fee payable to Monochrome’s bank details as shown on the bottom of the form.

Here’s what the form looks like:

For the SRN/HIN enter the same number you used to register your IBTC securities with Automic. The account name will be the entity name you registered as the owner of the securities at Automic.

Enter the total number of ETF Units you’d like to redeem or choose “Entire Investment” to move all the bitcoin from your ETF units in Gemini.

For the Gemini Wallet ID, use the BTC Receive address starting with “bc1….” that we noted down from the previous step. The Account Name will be the same as the entity name we entered when signing up for the Gemini Account.

The last page of the form is where all the required authorising signatories are to sign off on the redemption and accept the terms and conditions of the process:

The form can then be scanned and emailed or posted to the Monochrome PO Box address.

Once the form has been received and the redemption fee has been paid, you can expect the bitcoin to be transferred to your Gemini account within a few working days.

You’re then ready to move the bitcoin over to your cold storage.

Step 5: Sending BTC to your Cold Storage Wallet

Once you receive notification from Monochrome that your ETF units have been redeemed, your portfolio in your brokerage App and Automic will reflect the reduction in those ETF units. Remember, you’ve not sold any ETF units, only redeemed the underlying bitcoin, so no taxable event has taken place.

It’s now time to open up your preferred cold storage wallet and generate a receive address. There are many different cold storage solutions to choose from. For this example, we’ll use the BitBox 02 Bitcoin Only Edition. Your cold storage wallet may have a different interface and workflow for receiving funds, but its likely to be very similar to the example shown below:

We now copy and paste this cold storage receive address into the Send Crypto option on the Gemini exchange wallet as shown:

IMPORTANT: When moving large amounts of bitcoin, do not initially send all the funds without first doing a small test transaction first.

After validating your request with a multi factor code (eg a Text message, a passkey or an Authenticator app) you’ll be presented with a confirmation.

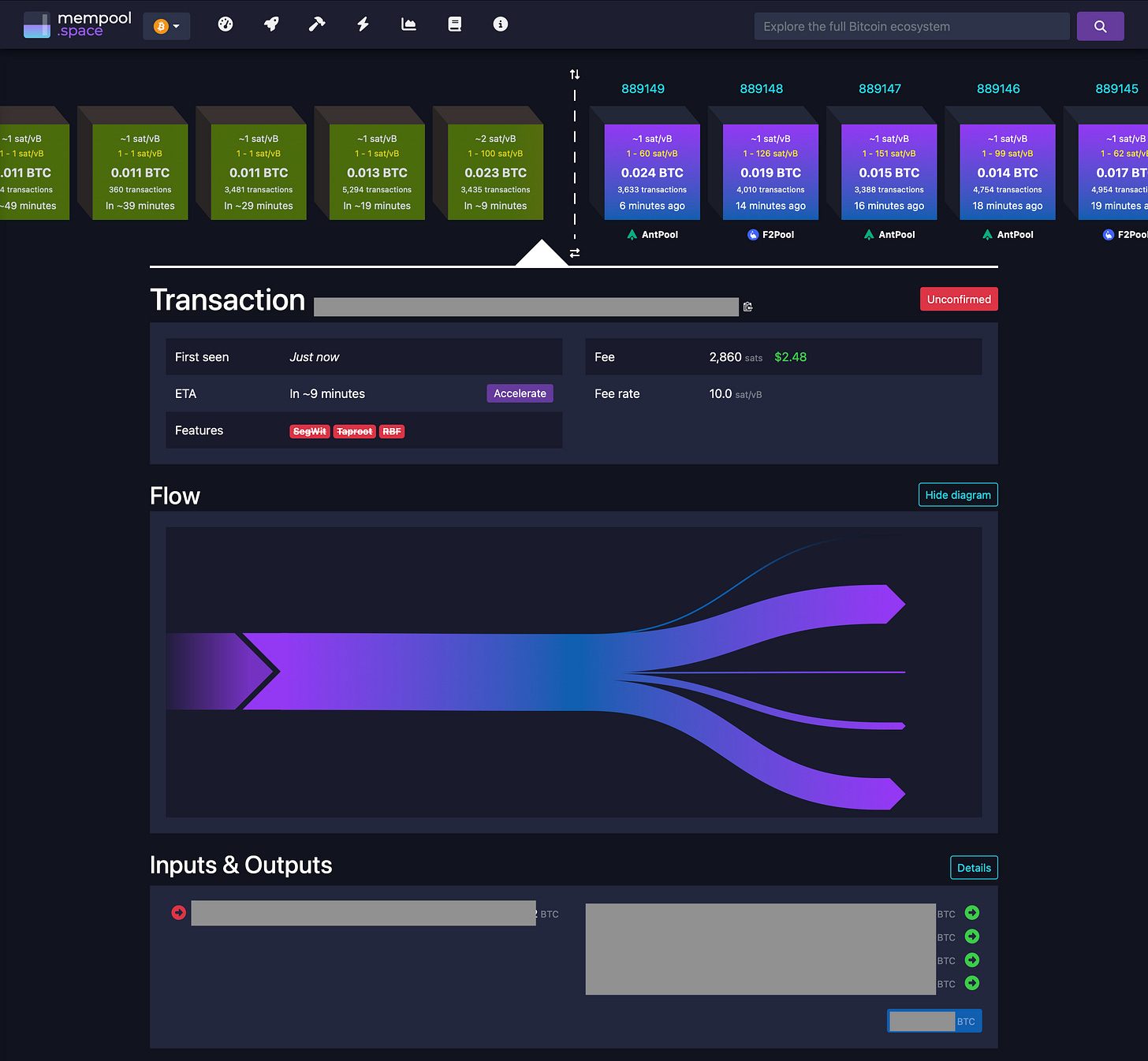

You can now click on the “View on Block Explorer” button to view the transaction and watch it go through the network in real time on the block chain:

You’ll then see your BitBox desktop app display the incoming transaction and after the first confirmation, your bitcoin is now spendable:

The Finish Line

Congratulations, you’ve now completed the full end-to-end process of buying bitcoin in bulk using your existing share brokerage app and you’ve redeemed the IBTC units for their equivalent value in Cold Storage bitcoin.

Sure, fiat friction has not been eliminated - there’s still plenty of steps, paperwork and waiting on multiple parties before you get your bitcoin.

But using the ETF allows you to shift the friction from the initial buy side to the self custody side of the transaction - and this is especially useful when a bull market is poised to rapidly take off.

Ready to learn more about bitcoin self custody?

Please visit mineracks.com/training to book a 1-on-1 consultation on the ideal bitcoin custody setup for your needs.

Missing any tools for generating and backing up your self custody setup?

Please visit mineracks.com/shop for everything you need to get serious about bitcoin.

The author and mineracks pty ltd have no commercial affiliation or marketing arrangement with Monochrome. The author has made use of the IBTC product in researching this article.

Please Subscribe to our Blog for more articles like this: